Driving a motorcycle can be exhilarating. It can be freeing, fun, and economical. But, unfortunately, it can also be very dangerous. For one such driver, the dangers of riding a motorcycle became a nightmare. In the case study below we examine motorcycle accident and injury compensation in Ontario. What are your options? And who can help?

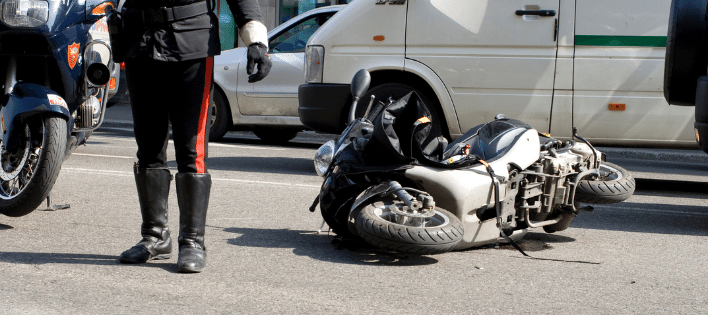

Facts of the Motorcycle Accident

The basic facts are this. F.L., as we will call him, was riding his motorcycle to work, traveling eastbound at the posted speed limit, and with the flow of traffic when the unthinkable happened. It was early morning, and traffic was steady with morning commuters. F.L. did not anticipate that the car ahead of him would stop so suddenly in the intersection. Before entering the intersection, F.L. saw a car turning left from the southbound direction, estimated the left-turning vehicle had cleared the intersection, and there was no danger.

The Collision

Unfortunately, F.L. was in imminent danger of a collision. F.L rear-ended the car ahead, flew over the handlebars, and landed on his back. He suffered a fractured lumbar spine along with other minor injuries. Bystanders called for emergency services after seeing F.L. lying in the roadway.

After the accident, the unidentified driver fled the scene of the accident. Independent witnesses told police that the car stopped suddenly to avoid an unidentified, left-turning westbound vehicle.

Determining Fault

The car ahead of F.L. was able to stop in time to avoid a collision with the unidentified driver. An engineering report determined that F.L. was traveling too closely behind the other car to be able to stop in time. And since F.L. rear-ended the car ahead, he was deemed at fault.

The defendant’s engineer provided statistical data for motorcycles and the extended distance required to stop at higher rates of speed. F.L. acknowledged that had he stopped suddenly, he would not have been able to remain seated on the motorcycle. He would have flown over the handlebars even without striking the car ahead.

Getting Legal Help

F.L. could not work and was extremely worried about his limited finances and how he would pay his bills after the accident. He decided he needed help and retained our firm. At that point, he did not know that he was eligible for any insurance claim or compensation.

We discussed with F.L. that he essentially had two claims 1) against his own insurer: a claim for no-fault accident benefits and 2) a fault-based tort claim against the unidentified driver.

Motorcycle Accident and Injury Compensation

Since F.L. had not filed income tax returns in the year before the accident, his insurer denied paying his income replacement benefit. F.L. worked full-time in construction and filed no income tax returns with Revenue Canadian in the 3 years before the accident.

He was able to qualify for an Income Replacement Benefit (“IRB, after he electronically filed his income tax returns. The claim for IRB’s is restricted by statute to the amount of earnings in the 52-weeks before the accident which has been reported to Revenue Canada.

Legal Options

We also issued a Statement of Claim against both the car ahead F.L. and his own insurer for damages caused by the unidentified driver. We were able to settle his claim for SABS with his own insurer to age 65, given the physical demands of his pre-accident job and the seriousness of the injury to his back.

Although F.L. was deemed at fault in the tort action, given conflicting independent witness statements, fault rules, and the defendant’s engineering report. We were able to settle his tort claim to pay him a reduced amount for damages by his own contributory negligence, his costs, and disbursements. In the end, we helped F.L. as much as we could, tirelessly working to get him as much compensation as possible. F.L. is still recovering, and it may still be a long road ahead. But, now at least he has the help to do so.

Disclaimer: The content of this article is a general guideline made available for educational purposes only and is not intended to be used as legal advice for the reader's specific situation nor in general. By reading our blog and website content, the reader acknowledges the above and understands there is no lawyer-client relationship created between you and Himelfarb Proszanski through this content. To get specific legal advice, we encourage you to book a free consultation with one of our lawyers to clarify the legal aspects of your situation.